Pro-Crypto Voice to Lead SEC in Post-Gensler Era

The U.S. Senate has officially confirmed Paul Atkins as the next Chair of the Securities and Exchange Commission (SEC) in a 52–44 vote on April 9, solidifying the Trump administration’s pivot toward a more crypto-friendly regulatory environment.

Atkins, a former SEC commissioner and Wall Street consultant, replaces Mark Uyeda, who had been serving as acting chair since January 20, following the departure of Gary Gensler. Gensler’s tenure was marked by aggressive enforcement actions against crypto firms and a hardline interpretation of securities laws in the digital asset space.

“A veteran of our Commission, we look forward to him joining with us, along with our dedicated staff, to fulfill our mission on behalf of the investing public,” said the SEC’s remaining commissioners in an official statement.

I’m pleased Paul Atkins is confirmed as Chairman of the SEC. I sat down w/ Mr. Atkins to discuss digital asset legislation, empowering Wyoming’s blockchain future & implementing reforms to the regulatory rulemaking process. I’m confident his leadership will bring positive change. pic.twitter.com/1cpGrNjSrg

— Senator Cynthia Lummis (@SenLummis) April 9, 2025

A Resume Tailored for the Crypto Era

Atkins brings a rare blend of regulatory experience and crypto industry involvement to the role. He previously served as co-chair of the Token Alliance, a blockchain advocacy group, and founded Patomak Global Partners, a consulting firm focused on risk and compliance.

He has also disclosed up to $6 million in crypto-related investments, including equity stakes in Anchorage Digital and Securitize, according to financial documents filed during the confirmation process.

While those investments raised concerns over potential conflicts of interest, supporters argue they demonstrate deep knowledge of the sector and could lead to informed policymaking.

“Atkins will provide regulatory clarity for digital assets, allowing American innovation to flourish,” said Senate Banking Committee Chair Tim Scott, praising the confirmation.

Crypto Task Force and Enforcement Rollbacks Continue

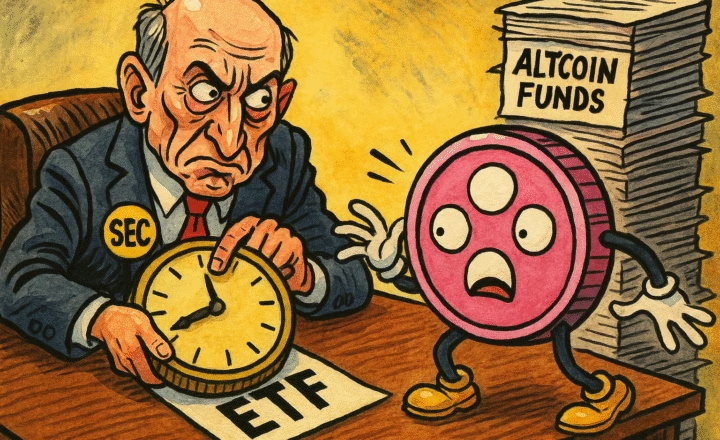

Atkins is expected to build on Trump’s recent efforts to roll back SEC enforcement under Gensler and replace it with a more consultative, principle-based framework.

In recent months, the SEC has:

-

Dropped lawsuits against firms like Coinbase, Uniswap, and Cumberland DRW

-

Created a Crypto Task Force to host public roundtables with industry stakeholders

-

Begun reviewing legacy guidance that labeled many crypto tokens as securities under the Howey test

Atkins echoed this new direction during his March confirmation hearing, where he emphasized the need for a “rational, coherent, and principled approach” to digital assets.

Disclosure Delay Raises Eyebrows, But Doesn’t Derail Appointment

Atkins’ confirmation was delayed by required financial disclosures tied to his marriage into the Humphreys family, owners of TAMKO Building Products, which generated over $1.2 billion in revenue in 2023.

Forbes estimated that the couple’s combined net worth exceeds $327 million, making Atkins one of the wealthiest SEC chairs in recent history. While some lawmakers questioned whether his fortune would cloud his judgment, others argued that financial independence could reduce political pressure and special interest influence.

Final Thoughts: A New Chapter for SEC and U.S. Crypto Policy

Atkins’ confirmation marks a strategic inflection point for the SEC. His leadership could pave the way for clearer rules of the road, greater regulatory predictability, and increased industry-government collaboration—especially as stablecoins, DeFi, and tokenized securities gain traction in both retail and institutional finance.

Still, challenges remain. Striking the right balance between market protection and innovation will test Atkins’ resolve—and determine whether the SEC can evolve from an enforcer to an enabler of the digital economy.

For now, one thing is clear: crypto has a seat at the table again—and the conversation is just getting started.