Altcoin Accumulation Continues Despite Mounting Unrealized Losses

World Liberty Financial (WLFI), the Trump family-affiliated crypto initiative, has added nearly $775,000 worth of SEI tokens to its portfolio, marking its latest acquisition in an ongoing altcoin buying spree that has yet to turn a profit.

According to data from Arkham Intelligence, WLFI acquired 4.89 million SEI tokens on April 12, using USDC transferred from its primary wallet. This purchase was executed through the same trading address that previously accumulated other altcoins such as TRX (Tron), AVAX (Avalanche), and ONDO (Ondo Finance).

Despite the growing size of its holdings, WLFI is reportedly underwater on every asset it has purchased. According to Lookonchain, WLFI has spent approximately $346.8 million on 11 different cryptocurrencies, including Bitcoin and Ether, but is sitting on a paper loss of $145.8 million—with over $114 million lost on Ethereum alone.

Eric Trump’s ETH Endorsement Aged Poorly

Adding to WLFI’s rough track record was a public endorsement of Ether by Eric Trump in a now-edited tweet posted on Feb. 3, where he urged followers to buy ETH. The original version reportedly included the phrase: “You can thank me later.”

In my opinion, it’s a great time to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

At the time of writing, ETH is trading at $1,611, down 55% from its Feb. 3 price of $2,879, meaning investors who followed the Trump endorsement have suffered steep losses.

This poorly timed call is emblematic of WLFI’s broader investment strategy, which critics have labeled aggressive, ill-timed, and politically charged.

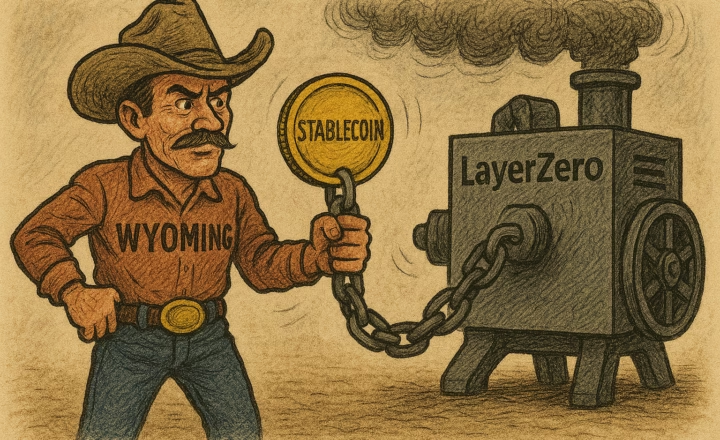

WLFI USD1 Stablecoin Appears on Major Platforms—Silently

In a parallel development, the logo for WLFI stablecoin, USD1, has quietly appeared on platforms including Coinbase, Binance, and CoinMarketCap—suggesting a soft launch of the coin’s branding.

However, WLFI has made no official announcement, and it remains unclear whether this rollout signals an imminent market debut or is merely part of an ongoing branding campaign.

The appearance of the logo has raised eyebrows, particularly amid growing bipartisan concern over Trump’s ties to USD1 and his broader ambitions for crypto-powered financial infrastructure.

Political Backlash Intensifies Over Trump’s Crypto Ties

During an April 2 hearing before the U.S. House Financial Services Committee, Representative Maxine Waters warned that Trump may seek to replace the U.S. dollar with his own stablecoin.

“Trump likely wants the entire government to use stablecoins—from Social Security payments to taxes. And which coin do you think he’d choose? His own, of course,” Waters said.

Committee Chair French Hill, a Republican, voiced similar unease, stating that if WLFI and USD1 are not meaningfully restricted by legislation, he could not support any stablecoin bill under discussion.

“If there is no effort to block the president of the United States from owning his stablecoin business, I will never be able to agree on supporting this bill,” Hill declared.

Final Thoughts: Political Crypto Meets Market Reality

WLFI’s aggressive altcoin strategy—and its mounting losses—underscore the risks of blending politics with high-volatility digital assets. While the Trump-linked project continues to expand its portfolio and branding, it has yet to demonstrate investment discipline or transparency.

At the same time, political scrutiny is intensifying, particularly as the USD1 stablecoin begins to make its presence felt across major exchanges. With WLFI’s crypto ventures already polarizing lawmakers, the project now finds itself at the intersection of digital finance, personal brand power, and national monetary policy debates.

As Trump’s financial footprint in crypto grows, so too does the pressure on regulators to draw clear lines between innovation and influence—especially when the White House and blockchain begin to converge.