“We Need That”: Powell Backs Congressional Push for Legal Framework

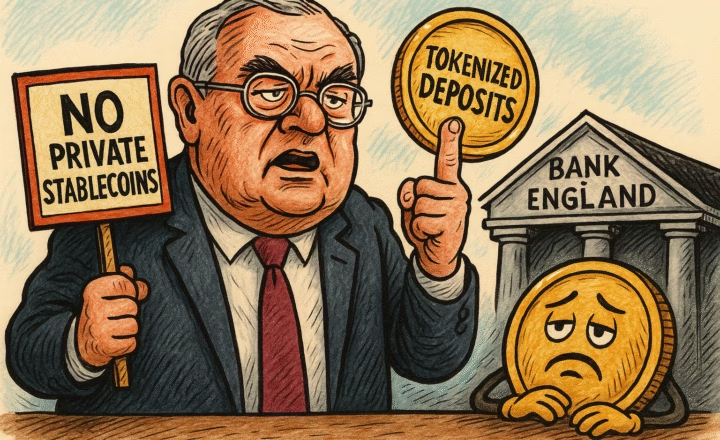

Federal Reserve Chair Jerome Powell has once again voiced support for federal legislation to regulate stablecoins, stating that digital dollar-pegged assets are likely to see broad consumer adoption and therefore require clear legal and regulatory guardrails.

Speaking at the Economic Club of Chicago on April 16, Powell described stablecoins as a “digital product that could actually have fairly wide appeal” if implemented with the right consumer protections.

“Establishing a legal framework for stablecoins is a good idea. We need that. There isn’t one now,” Powell said during the panel discussion.

From Crypto Collapse to Congressional Action

Powell referenced the crisis years of 2022–2023, during which multiple high-profile crypto platforms collapsed, prompting renewed calls for regulatory clarity.

“We worked with Congress to try to get a legal framework for stablecoins, which would have been a nice place to start. We were not successful,” he noted, referring to failed legislative attempts during that period.

Now, with crypto entering a more mainstream phase, Powell said Congress is again revisiting stablecoin regulation, signaling optimism that new legislation could finally pass.

Stablecoins Are “Money,” Says Powell

This isn’t the first time Powell has underscored the importance of federal oversight for stablecoins. In June 2023, he told the House Financial Services Committee that stablecoins are “a form of money” and must be subject to “robust” federal oversight.

His remarks come as stablecoins continue to dominate cryptocurrency use cases, particularly for remittances, DeFi, and crypto trading. USDC and USDT, both pegged to the U.S. dollar, are among the most widely circulated tokens in the digital asset ecosystem.

Trump Administration Pushes Forward With Crypto Legislation

The renewed momentum for a stablecoin framework comes amid a broader pro-crypto policy shift under President Donald Trump.

The President’s Council of Advisers on Digital Assets, established earlier this year, is tasked with shaping U.S. leadership in crypto regulation and innovation. Its executive director, Bo Hines, said at the Digital Asset Summit in March that passing comprehensive stablecoin legislation was a “top priority” for the Trump administration.

“A final stablecoin bill could arrive at the president’s desk in the next two months,” Hines said, pointing to the recent Senate approval of the GENIUS Act.

The GENIUS Act outlines federal standards for stablecoin issuance, reserves, and compliance, and has already passed through the Senate Banking Committee.

Final Thoughts: A Regulatory Turning Point for Digital Dollars

Powell’s comments reflect a growing consensus that stablecoins are here to stay—and that the lack of federal rules is becoming a risk in itself.

With bipartisan interest converging and the Trump administration pushing for rapid implementation, the U.S. may soon see its first nationwide regulatory framework for stablecoins—a milestone that could shape the future of digital finance, both domestically and globally.

As stablecoins become an integral part of payment systems and decentralized markets, clarity and consistency in regulation may finally catch up to the technology.