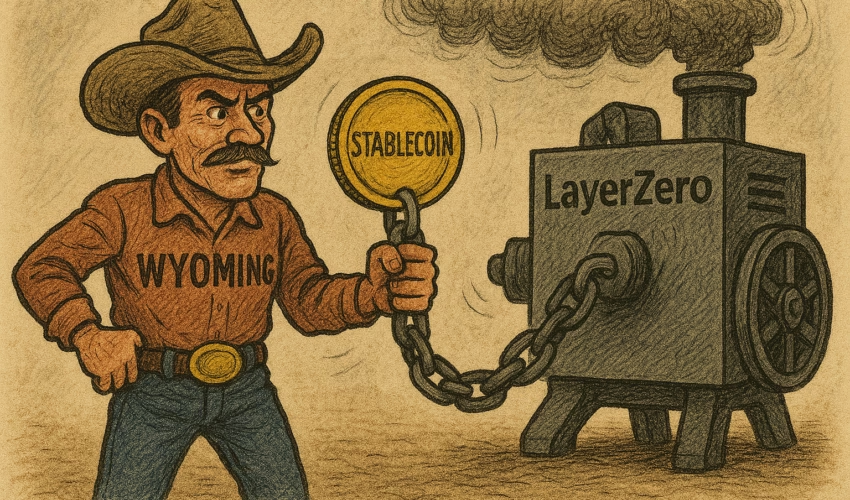

Governor Gordon and the Stable Token Commission push forward on the first U.S. state-issued stablecoin, aiming to bring blockchain to public finance

Wyoming is poised to become the first U.S. state to issue its own stablecoin, with a target launch date set for July 2025, according to Governor Mark Gordon. Speaking at the DC Blockchain Summit on March 26, Governor Gordon emphasized the state’s forward-thinking approach to blockchain integration and formally announced LayerZero as the technical partner for the stablecoin’s development and distribution.

The initiative is part of a broader legislative and strategic effort to place Wyoming at the forefront of crypto policy and digital asset innovation in the United States. The project is being overseen by the Wyoming Stable Token Commission, which has already begun deploying the stablecoin across multiple test networks.

The Road to a State-Issued Stablecoin

Wyoming’s stablecoin efforts trace back to the introduction of the “Wyoming Stable Token Act” in February 2022. The bill proposed a state-issued stablecoin pegged 1:1 to the U.S. dollar, fully redeemable for fiat, and backed by highly liquid and secure reserves such as short-term U.S. Treasury Bills and repurchase agreements.

.@GMX_IO @MIM_Spell related contracts have been hacked for ~6,260 ETH (worth ~$13M) pic.twitter.com/LZzMADWB3n

— PeckShield Inc. (@peckshield) March 25, 2025

The act was signed into law in March 2023, empowering the state treasury to assemble a team of professional accountants, auditors, legal advisors, and blockchain developers to create and manage the token. Since then, the Wyoming Stable Token Commission has been tasked with overseeing the design, issuance, and regulatory compliance of the token.

In August 2024, Governor Gordon spoke at the Wyoming Blockchain Symposium, revealing that the state was targeting a Q1 2025 launch window. At the time, he criticized the Federal Reserve’s centralized influence on financial innovation, describing it as “a drag on innovation” and expressing frustration with the “too big to fail” ethos that emerged after the 2008 financial crisis.

Strategic Partnership with LayerZero

At the DC Blockchain Summit, both Governor Gordon and Anthony Apollo, Executive Director of the Wyoming Stable Token Commission, confirmed that LayerZero had been selected as the state’s development and distribution partner. LayerZero, known for its cross-chain interoperability infrastructure, will help ensure the stablecoin can function across multiple blockchains—an essential feature for scalability, accessibility, and composability in the DeFi and enterprise ecosystems.

“The Stable Token Commission has formally engaged LayerZero as our token development and distribution partner, and we have stable tokens — Wyoming stable tokens — on several test networks,” Apollo said.

LayerZero’s involvement suggests that Wyoming intends to build a robust, cross-chain-compatible stablecoin, potentially opening the door for interoperable government-backed tokens in public and private sector use cases.

A Vision for Onchain Public Finance

Beyond issuing a digital dollar proxy, Wyoming’s vision includes making the state’s entire budget and spending transparent via blockchain. In an interview with Cointelegraph, Apollo emphasized that onchain public budgeting could revolutionize transparency, accountability, and efficiency in government operations. “The future of government is not just digital, it’s onchain,” Apollo stated.

Such a move would make Wyoming one of the first governmental entities globally to operate its fiscal management on a blockchain ledger—a radical step that could influence municipal, state, and even federal public finance practices in the years to come.

Political and Regulatory Climate

Wyoming’s pro-crypto stance is well-documented. The state is represented in Congress by Senator Cynthia Lummis, a vocal advocate for Bitcoin and blockchain policy. The state has passed over 20 pieces of crypto-friendly legislation in recent years, including frameworks for decentralized autonomous organizations (DAOs), digital identity, and tokenized asset regulation.

Wyoming’s legal infrastructure and political commitment to blockchain innovation make it a natural leader in the state-level stablecoin movement. The upcoming launch of the Wyoming stable token represents a culmination of years of legal groundwork and industry consultation.

Investor Implications

For digital asset investors, the Wyoming stablecoin project presents several notable implications:

-

Institutional Legitimacy: A state-issued and legally backed stablecoin could offer a level of trust and transparency that surpasses even popular private stablecoins like USDT or USDC.

-

Regulatory Precedent: If successful, Wyoming’s model may be adopted by other U.S. states, setting a precedent for subnational digital currencies and decentralized fiscal governance.

-

Interoperability Use Cases: LayerZero’s involvement hints at potential DeFi integration, creating novel opportunities for onchain yield strategies and cross-chain liquidity using state-issued assets.

-

Stablecoin Competition: The entry of government-backed stablecoins could pressure private issuers to improve their reserve transparency, auditing practices, and compliance measures.

While the Wyoming stable token is not designed to compete with the Federal Reserve’s hypothetical central bank digital currency (CBDC), it may serve as a practical, localized alternative—especially for residents and businesses within the state seeking a digital payment solution rooted in U.S. dollar value.

Conclusion

Wyoming’s stablecoin project marks a milestone in the evolution of digital assets and state-level innovation. With a concrete legislative foundation, a high-profile technical partner, and a bold vision for onchain governance, the state may soon become the first jurisdiction in the U.S. to bring a fully operational public stablecoin to market.

As the July launch window approaches, all eyes will be on how Wyoming manages token issuance, liquidity, legal oversight, and real-world utility. For investors and policymakers alike, the Wyoming Stable Token could signal the beginning of a new paradigm in public finance and digital asset regulation.