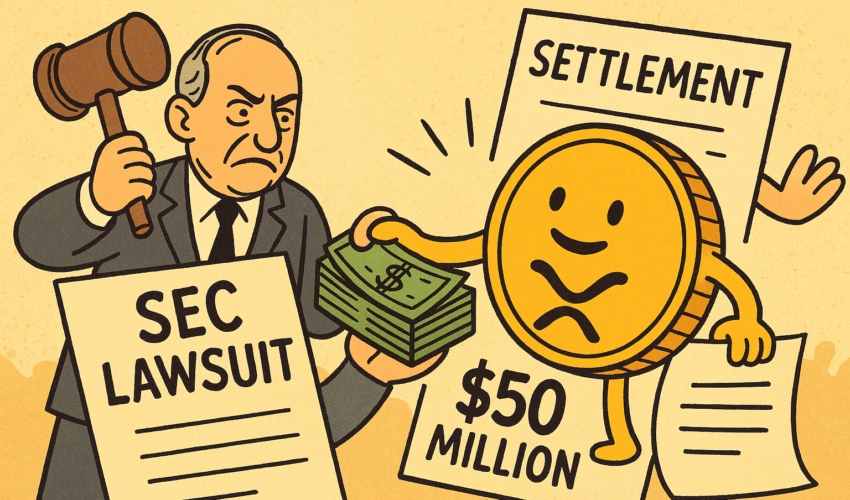

The high-profile legal battle ends with a significant settlement, setting a precedent for U.S. crypto regulation

After nearly four years of legal contention, Ripple Labs has reached a settlement with the U.S. Securities and Exchange Commission (SEC), agreeing to pay a $50 million penalty—significantly reduced from the originally proposed $125 million. The agreement marks the end of one of the most significant regulatory confrontations in the crypto industry’s history and may serve as a bellwether for future enforcement actions.

The settlement includes no admission of wrongdoing and brings long-awaited closure to a case that has kept investors, developers, and regulators on edge since 2020. With the SEC dropping its remaining claims and Ripple withdrawing its counterclaims, the case has officially come to a close.

Background: A Clash Over XRP’s Status

The SEC filed the lawsuit against Ripple Labs and its executives Brad Garlinghouse and Chris Larsen in December 2020, alleging that Ripple’s sale of XRP constituted an unregistered securities offering. The commission argued that XRP was a security under the Howey Test, while Ripple countered that XRP is a currency and should not be subject to securities laws.

The case quickly became a proxy war over the legal classification of cryptocurrencies in the United States. Ripple’s defense garnered support from major industry stakeholders, and the proceedings attracted international attention due to their implications for the broader digital asset market.

Throughout the legal battle, XRP’s status on exchanges wavered—many platforms delisted or restricted XRP trading, leading to significant price volatility and investor uncertainty.

Terms of the Settlement

Under the terms of the agreement finalized earlier this week:

-

Ripple will pay a $50 million fine to the SEC.

-

The remaining $75 million of the initially proposed penalty will be waived.

-

The SEC has agreed to drop its remaining charges against Ripple and its executives.

-

Ripple, in turn, has agreed to drop its counterclaims against the SEC.

The settlement includes no requirement for Ripple to register XRP as a security and does not impose additional operational restrictions on the company. However, Ripple is expected to maintain transparency and ongoing compliance efforts moving forward.

Market Reaction

The settlement news sent a wave of optimism through the crypto market, with XRP rising over 5% in the hours following the announcement. The broader market also responded positively, with investors interpreting the outcome as a sign that regulators may take a more cooperative and measured approach toward enforcement.

Ripple’s CEO Brad Garlinghouse expressed satisfaction with the resolution, calling it a “monumental moment for crypto clarity in the United States.” In a public statement, he emphasized Ripple’s commitment to innovation and regulatory engagement moving forward.

Market analysts noted that the reduced fine and absence of restrictive measures make the settlement a relative victory for Ripple. Legal experts suggested that the SEC may have opted for a pragmatic resolution to avoid further legal entanglements and unfavorable precedents.

Implications for U.S. Crypto Regulation

The conclusion of the Ripple case has wide-ranging implications:

-

Legal Clarity for XRP: While the SEC never explicitly declared XRP to be a non-security, the lack of registration requirements in the settlement strengthens Ripple’s case for XRP’s classification as a digital currency.

-

Precedent for Other Tokens: Projects facing similar scrutiny, such as Cardano (ADA), Solana (SOL), and Polygon (MATIC), may take cues from the Ripple case in structuring their defenses.

-

Regulatory Strategy Shift: The SEC’s willingness to settle may indicate a softening stance or recognition of the legal ambiguity surrounding crypto assets under current law.

-

Increased Lobbying for Legislation: Ripple’s case has galvanized industry support for clearer congressional regulation, such as the Financial Innovation and Technology for the 21st Century Act (FIT21), which seeks to define the roles of the SEC and CFTC in overseeing digital assets.

Investor Takeaways

For investors, the settlement brings long-awaited clarity and may restore confidence in XRP as a tradable asset. With legal uncertainties now removed, Ripple is likely to resume full-scale business development efforts, including cross-border payment integrations and partnerships with financial institutions.

Institutional investors who had previously shied away from XRP due to legal concerns may now reconsider their stance. Additionally, exchanges that had delisted XRP are expected to reevaluate relisting, which could enhance liquidity and visibility for the asset.

The ruling may also influence portfolio strategy, as XRP may now carry reduced regulatory risk compared to other tokens under active investigation. However, caution remains warranted, as the regulatory environment in the U.S. continues to evolve.

Final Thoughts

Ripple’s settlement with the SEC marks the end of a defining chapter in crypto regulation and underscores the need for legislative clarity. While the outcome is a relative win for Ripple and the industry, it also highlights the unresolved nature of digital asset classification in the United States.

Investors should monitor how this case influences ongoing legal battles and how lawmakers respond in shaping a more robust and predictable regulatory framework. In the meantime, the Ripple decision may provide a boost to market sentiment and encourage more proactive engagement between crypto firms and regulators.

As the dust settles, one thing is clear: Ripple’s fight has set a precedent that will resonate across the crypto space for years to come.