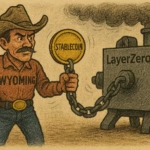

GENIUS Act Could Reshape Stablecoin Regulation Landscape

U.S. Senate Majority Leader John Thune has reportedly informed Republican colleagues that the chamber will vote on a federal stablecoin bill before Memorial Day (May 26), according to an April 29 report from Politico.

The legislation in question is the Guiding and Establishing National Innovation for U.S. Stablecoins Act, or GENIUS Act, introduced in February by Senator Bill Hagerty and approved by the Senate Banking Committee in March.

The bill is seen as one of the most advanced pieces of legislation aimed at establishing a regulatory framework for payment stablecoins in the United States.

The GENIUS Act would effectively prohibit non-approved entities from issuing payment stablecoins in the U.S., limiting issuance to “permitted payment stablecoin issuers” under federal oversight.

A companion bill in the House, the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy), is already being discussed by House Republicans, who also control that chamber.

Trump Administration’s Crypto Orders Fuel Legislative Momentum

Although Thune made no public remarks about crypto or blockchain in his summary of President Donald Trump’s first 100 days, the administration has moved aggressively on digital asset policy.

On January 23, Trump signed an executive order establishing a working group to study:

-

The creation of a strategic crypto stockpile

-

A regulatory framework for stablecoins

Republican lawmakers responded by fast-tracking the GENIUS and STABLE bills, signaling a broader effort to bring stablecoin activity under formal regulatory control.

Conflict of Interest Concerns Mount Over USD1 Stablecoin

The legislative push comes amid growing scrutiny over potential conflicts of interest involving Trump and the crypto industry.

Shortly before the GENIUS Act’s introduction, a crypto firm backed by Trump’s family — World Liberty Financial — launched a U.S. dollar-pegged stablecoin, USD1. Critics, particularly from the Democratic Party, argue that Trump’s direct ties to a private stablecoin issuer could compromise legislative neutrality and pose systemic financial risks.

“This presents an extraordinary conflict of interest that could create unprecedented risks to our financial system,” one Democratic lawmaker said.

Despite the controversy, the Trump administration and GOP lawmakers appear to be proceeding with efforts to codify stablecoin rules into federal law.

Final Thoughts: Stablecoin Clarity Edges Closer to Reality

If passed, the GENIUS Act would represent the first comprehensive federal regulation of stablecoin issuers in the U.S., establishing guardrails around who can issue them and under what conditions.

While questions of political influence and regulatory capture persist, the bill’s advancement reflects growing bipartisan recognition that stablecoins need a formal legal framework—especially as their use expands across payment systems, DeFi platforms, and tokenized finance.

The next few weeks could mark a watershed moment for stablecoin policy, with the Senate potentially setting a precedent for how digital dollars are regulated in a crypto-powered future.