SEC Approves Then Abruptly Halts Bitwise ETF Conversion, Leaving Fund in Regulatory Limbo

In a surprising regulatory twist, the U.S. Securities and Exchange Commission (SEC) granted approval to Bitwise Asset Management’s application to convert its Bitwise 10 Crypto Index Fund into an exchange-traded fund (ETF)—only to immediately suspend the order hours later pending further review.

The sudden reversal has raised questions among analysts and industry stakeholders, with some attributing the move to internal political maneuvering and the lack of established regulatory standards for crypto-based ETFs.

Accelerated Approval Followed by Immediate Pause

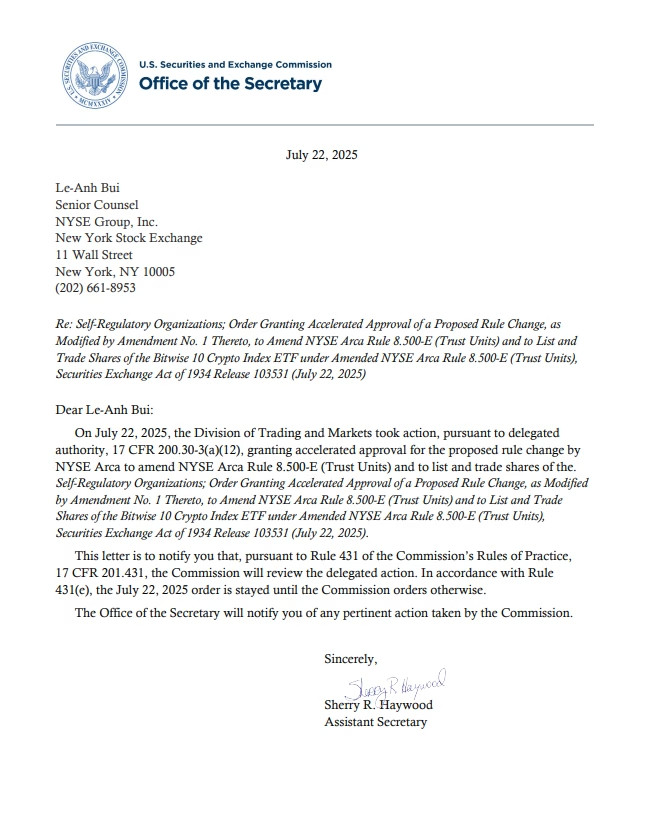

On Tuesday, the SEC’s Division of Trading and Markets issued an “accelerated approval” for Bitwise to convert its Bitwise 10 Crypto Index Fund (BITW) into a regulated ETF. The fund currently provides diversified exposure to multiple cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH).

However, later that same day, SEC Assistant Secretary Sherry Haywood issued a statement saying the order is “stayed until the Commission orders otherwise,” meaning the earlier approval is now on hold. The Commission will now conduct a review of the delegated action.

This effectively stalls Bitwise’s ability to proceed with the conversion, despite the initial green light.

Analysts Question Timing and Intent

ETF analysts were quick to respond. James Seyffart, a Bloomberg ETF expert, said the ETF approval had been paused by one or more commissioners. “Meaning they cannot actually convert it into an ETF… yet,” Seyffart posted on X (formerly Twitter).

He noted that the approval arrived earlier than expected, as a decision wasn’t due until the following week. This timing discrepancy further fueled speculation about internal conflict within the Commission.

Nate Geraci, president of NovaDius Wealth Management, called the situation “bizarre” and drew parallels to a similar delay involving Grayscale’s Digital Large Cap ETF, which also saw approval paused shortly after being granted on July 1.

Bloomberg’s Eric Balchunas echoed this sentiment, remarking, “IMO both of these should be allowed to convert/uplist ASAP,” but also suggested that the Commission may be waiting to establish standard listing guidelines for crypto ETFs before moving forward.

Regulatory Politics Behind the Scenes?

Some observers speculated that internal politics could be behind the sudden halt.

Scott Johnsson, general partner at Van Buren Capital, theorized that the ETF approval was initially issued under delegated authority to preempt potential disruption by Commissioner Caroline Crenshaw, the SEC’s sole Democrat member, who is seen as more skeptical of crypto-related products.

Johnsson also floated the idea that the delay may be a procedural tactic to bypass the 240-day statutory deadline for ETF approval. He criticized both theories as indicative of regulatory “funny business” under the leadership of new SEC Chair Paul Atkins.

While these remain speculative, they highlight the lack of transparency and consistency that continues to challenge crypto ETF issuers.

Broader Implications for Crypto ETFs

The Bitwise case is not occurring in isolation. On July 17, the SEC also extended its deadline for making a decision on in-kind redemptions for both Bitwise’s spot Bitcoin and Ether ETFs. This move follows similar delays faced by other fund managers.

The repeated pauses suggest a pattern of regulatory caution—or confusion—as the agency grapples with how to effectively incorporate crypto-based financial products into traditional markets.

According to a report by journalist Eleanor Terrett, the SEC is actively working with stock exchanges and asset managers to streamline ETF approvals, particularly for crypto-related instruments. This may include automating parts of the existing application process and potentially eliminating the need for 19b-4 filings, which are currently required for ETF rule changes.

Bitwise’s Position and Market Impact

Bitwise first submitted its ETF conversion request in November, aiming to transform its OTC-traded BITW fund into a formal ETF listed on major exchanges. The fund’s diversified exposure across major cryptocurrencies made it a candidate for broader institutional adoption.

With the pause now in place, Bitwise must await further guidance from the Commission before taking additional steps. The company has not yet issued an official comment on the development.

Meanwhile, the news has left the crypto and investment community in a state of uncertainty. The initial approval signaled progress toward greater ETF integration for digital assets, but the rapid reversal highlights the persistent regulatory headwinds the sector faces.

Conclusion

The SEC’s abrupt pause of Bitwise’s ETF conversion reflects the ongoing complexities and internal tensions surrounding crypto regulation in the United States. As the agency navigates competing priorities, political influences, and a rapidly evolving market, ETF issuers are left in a holding pattern.

While some industry leaders remain optimistic that a more streamlined regulatory framework is on the horizon, the current situation illustrates how even approved products can be halted at the eleventh hour. For now, Bitwise and its investors must wait—once again—for the SEC to make up its mind.