Nearly 30 Industry Groups Argue Staking Is a Technical Function, Not a Security

A coalition of nearly 30 crypto advocacy organizations is urging the U.S. Securities and Exchange Commission (SEC) to provide clear, principles-based guidance on crypto staking, arguing the practice does not constitute an investment activity under U.S. securities laws.

In an April 30 letter addressed to SEC Commissioner Hester Peirce, who leads the agency’s Crypto Task Force, the Proof of Stake Alliance (POSA) — a division of the Crypto Council for Innovation (CCI) — said staking is a core technical process that should not fall under traditional financial regulations.

“Staking isn’t niche — it’s the backbone of the decentralized internet,” the letter reads.

The appeal comes in response to the SEC’s ongoing call for public comment on how staking and liquid staking — where users lock tokens to earn yield — should be treated under federal law.

Staking Doesn’t Meet Howey Test, Groups Say

The POSA coalition argued that crypto staking does not meet the four-pronged Howey Test definition of an “investment contract,” as:

-

Stakers retain ownership of their assets.

-

Staking rewards are determined by blockchain protocols, not by managerial efforts.

-

Staking providers do not generate profit through discretionary decision-making like traditional firms.

As a result, applying securities law to staking would be overly prescriptive and could “freeze market structures” and “stifle innovation”, the letter warned.

The coalition asked the SEC to adopt a principles-based framework, similar to previous staff guidance issued for proof-of-work mining operations.

“In the past 4 months, we’ve seen more movement and constructive dialogue with the SEC than in the past 4 years,” the group noted.

“The industry is stepping up with concrete principles — this is a reflection of a new collaborative approach.”

Major Industry Players Back the Call

The letter was co-signed by major crypto stakeholders, including:

-

Andreessen Horowitz (a16z)

-

Consensys (developer of MetaMask)

-

Kraken, which recently reinstated staking services in the U.S.

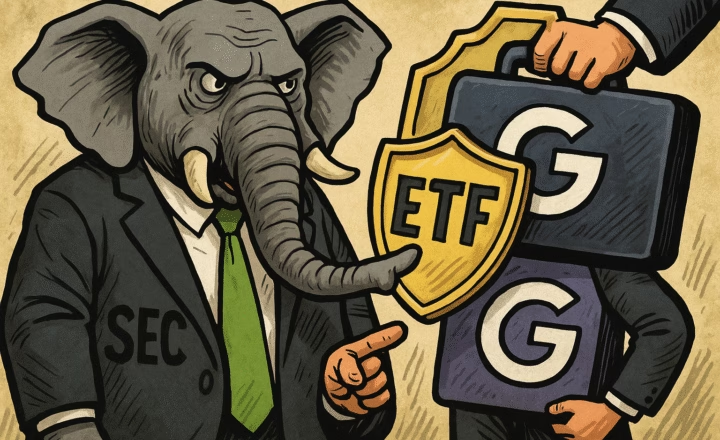

Despite rising interest, the SEC has yet to approve a crypto staking ETF, and on April 14, it delayed its decision on whether to allow staking in Grayscale’s spot Ether ETF.

Still, momentum is building. Bloomberg ETF analyst James Seyffart recently projected that a staking-enabled Ether ETF could debut as early as May 2025, pending regulatory clarity.

Final Thoughts: Defining Staking Will Shape the Future of DeFi

The crypto industry’s push for regulatory clarity on staking is quickly becoming one of the most pivotal legal debates in the U.S. crypto space. The outcome could determine how decentralized networks evolve, how staking services are offered, and whether staking can be integrated into regulated financial products like ETFs.

For now, the SEC’s decision could set a precedent that impacts every major blockchain ecosystem, including Ethereum, Solana, and Avalanche. The question is no longer whether staking is important — it’s whether regulators will treat it as a utility or a security.