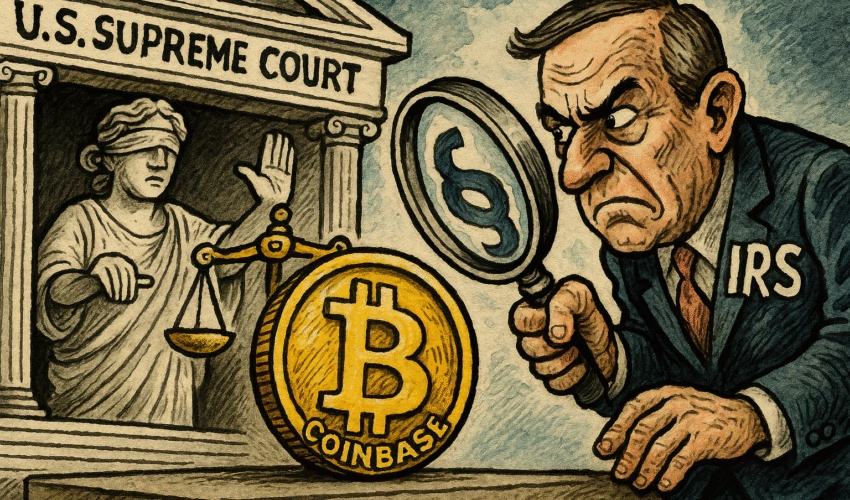

U.S. Supreme Court Declines to Hear Case on IRS Access to Coinbase User Data

The U.S. Supreme Court has declined to review a case challenging the IRS’s authority to obtain cryptocurrency transaction data from Coinbase users, allowing a lower court ruling against plaintiff James Harper to stand.

Background on the Harper Case

Harper had filed a lawsuit in 2020 against the Internal Revenue Service (IRS), alleging that the agency had violated his Fourth Amendment rights by compelling Coinbase to hand over his personal financial data through a “John Doe” summons. This legal instrument allows the IRS to collect information on unnamed individuals suspected of tax evasion.

Harper argued that the IRS’s actions constituted an unlawful search and seizure of his private data without proper notice or a warrant. However, in March 2021, the U.S. District Court for the District of New Hampshire dismissed the case. Harper appealed to the First Circuit, which upheld the dismissal. The Supreme Court’s decision not to hear the case means that the lower court’s ruling is final.

Implications for Crypto User Privacy

The outcome is a significant setback for digital privacy advocates, as it effectively upholds the government’s ability to access crypto transaction data without individual warrants. In support of Harper, Coinbase filed an amicus brief, warning that the decision would allow the U.S. government to track and monitor every past and future crypto transaction without adequate legal checks.

“We believe in tax compliance, but this goes far beyond a narrow and tailored request and far beyond crypto,” said Paul Grewal, Coinbase’s Chief Legal Officer. “This applies to banks, phone companies, ISPs, email — you name it.”

Grewal argued that citizens deserve the same privacy protections for their digital accounts as they do for traditional mail.

Surge in IRS Letters to Crypto Users

Meanwhile, crypto tax software firm CoinLedger has reported a 758% increase in users mentioning IRS warning letters during support interactions. Although unrelated directly to the Supreme Court ruling, the spike suggests growing IRS scrutiny of unreported or underreported digital asset transactions.

“These letters don’t necessarily indicate wrongdoing,” CoinLedger explained. “In many cases, recipients are simply crypto investors known to the IRS through John Doe Summonses issued to exchanges like Coinbase and Poloniex.”

Looking Ahead

The decision not to hear Harper’s case reinforces the legal precedent that the IRS can collect broad crypto transaction data without violating the Fourth Amendment — a stance that could have far-reaching implications for digital privacy rights in the United States.

As regulatory scrutiny intensifies, crypto investors may face more comprehensive monitoring and enforcement actions, underscoring the importance of accurate tax reporting and a proactive understanding of evolving legal standards.