Lummis and Moreno Say Current Tax Law Puts U.S. Crypto Firms at Global Disadvantage

U.S. Senators Cynthia Lummis and Bernie Moreno are calling on Treasury Secretary Scott Bessent to modify a tax provision that could significantly impact how corporations report and pay taxes on digital asset holdings.

In a May 12 letter, the two lawmakers urged Bessent to “exercise [the Treasury Department’s] authority” to change the definition of “adjusted financial statement income” under current law — a move that could ease the tax burden on crypto-related corporate activity.

“Our edge in digital finance is at risk if U.S. companies are taxed more than foreign competitors,” Lummis posted on X on May 13.

Our edge in digital finance is at risk if U.S. companies are taxed more than foreign competitors. @berniemoreno & I urged the @USTreasury to lift an unintended tax burden on U.S. digital asset companies. To lead the world in digital assets, we need a level playing field.⬇️ pic.twitter.com/V7pwAUqRc4

— Senator Cynthia Lummis (@SenLummis) May 13, 2025

The suggested change targets a provision in the Inflation Reduction Act, signed into law in 2022, which imposes a 15% minimum tax on corporations with more than $1 billion in profits over three years — including unrealized gains from digital assets.

Unrealized Crypto Gains Could Be Taxed Under Current Rules

Under current interpretation, corporate crypto holdings — even those not sold — could be taxed, as unrealized gains are factored into the “adjusted financial statement income” calculation.

Lummis and Moreno argue that this puts U.S.-based digital asset companies at a global disadvantage, particularly compared to jurisdictions like Switzerland, Singapore, and the UAE, which have adopted more crypto-friendly tax policies.

“The proposed modification would provide relief to corporations that invest in digital assets,” the senators wrote.

Both lawmakers have emerged as key voices on crypto policy in the Senate:

-

Lummis has long supported pro-crypto legislation and regulatory clarity.

-

Moreno, elected in 2024 with backing from crypto-aligned PACs, has quickly aligned himself with digital asset reform efforts.

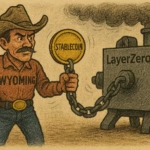

Legislative Context: Stablecoin Bill Also in Focus

The tax relief proposal arrives as the Senate prepares for another potential vote on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, a bill co-sponsored by Lummis aimed at regulating payment stablecoins.

A motion to advance the bill failed on May 8, largely due to Democratic opposition linked to former President Donald Trump’s crypto affiliations.

Despite the setback, Lummis signaled her continued commitment to advancing digital asset policy, and the Senate may bring the measure up for reconsideration in the coming days.

Final Thoughts: Regulatory Reform Gaining Urgency

The latest push from Lummis and Moreno reflects growing concerns that outdated tax rules could stifle U.S. innovation in digital finance. With global competitors offering more favorable environments, lawmakers are increasingly focused on ensuring regulatory frameworks and tax policy support — not hinder — the crypto sector’s growth.

If the Treasury acts on the request, it could mark a significant step in creating a more equitable tax environment for digital asset corporations, while helping position the U.S. as a leader in blockchain innovation.