Hedge Fund Titan Warns of “Debt Doom Loop” and Urges Investors to Hedge with Store-of-Value Assets

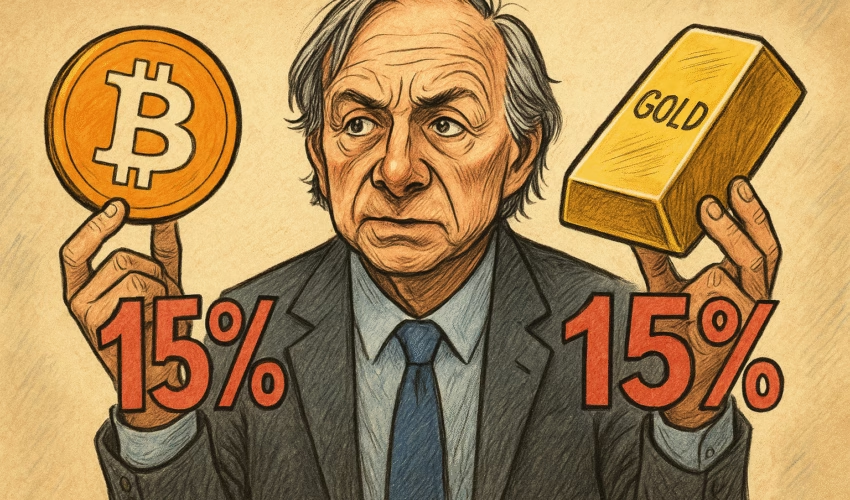

Ray Dalio, billionaire hedge fund manager and founder of Bridgewater Associates, has advised investors to allocate up to 15% of their portfolios to Bitcoin or gold, citing growing risks tied to America’s ballooning national debt and the devaluation of fiat currency.

Speaking on the Master Investor podcast on Sunday, Dalio said the optimal return-to-risk ratio in today’s macroeconomic environment would include a meaningful allocation to hard assets like Bitcoin and gold.

“If you were optimizing your portfolio for the best return-to-risk ratio, you would have about 15% of your money in gold or Bitcoin,” Dalio stated.

This marks a significant shift from his earlier guidance in January 2022, when he suggested just 1% to 2% of one’s portfolio be allocated to Bitcoin.

Dalio Still Favors Gold Over Bitcoin

Despite acknowledging Bitcoin’s value as a portfolio diversifier, Dalio noted that his personal exposure to the asset remains limited.

“I have some Bitcoin, but not much,” he admitted, adding that he still strongly prefers gold to Bitcoin as a store of value.

He left the decision on how to split the 15% allocation between Bitcoin and gold up to individual investors, but reiterated that both serve as important hedges against systemic risk and currency debasement.

Mounting U.S. Debt Triggers Alarm

Dalio’s comments come amid growing concern over the United States’ national debt, which has surged to $36.7 trillion, according to the latest U.S. Treasury data.

“The issue is the devaluation of money,” Dalio warned, emphasizing that continued debt issuance will likely accelerate the erosion of purchasing power.

He noted that the U.S. government may need to issue an additional $12 trillion in Treasurys over the next year just to service its existing obligations.

This forecast aligns with a Treasury Department report released on Monday, which projected $1 trillion in new borrowing in Q3 2025—a figure that is $453 billion higher than previous estimates. The increase is attributed to weaker-than-expected cash flows and declining reserves.

Furthermore, the Treasury expects to borrow another $590 billion in Q4, raising further questions about the sustainability of the current fiscal path.

Skepticism About Bitcoin as a Reserve Currency

While Dalio views Bitcoin as a useful hedge, he remains skeptical about its ability to become a global reserve currency.

“Governments can see who is doing what transactions on it,” he said, pointing out the lack of privacy and transparency of the blockchain as potential limitations.

Dalio also cited concerns about possible vulnerabilities in Bitcoin’s code, implying that such risks could prevent sovereign entities from adopting it as a reliable store of value.

His remarks reflect a broader debate in financial and regulatory circles about the role of cryptocurrencies in national monetary systems.

Market Reaction: Bitcoin and Gold Continue to Climb

Both Bitcoin and gold have performed well in 2025, driven by rising inflation, geopolitical uncertainty, and institutional demand for non-correlated assets.

The man has a point. https://t.co/zaUGGjx6im pic.twitter.com/tIF8XX7KRu

— Bitwise (@BitwiseInvest) July 28, 2025

As of the time of writing, Bitcoin is trading around $118,100, roughly 4% below its all-time high of $123,230 recorded on July 14, according to TradingView. Gold has also reached multiple new highs in recent months, reaffirming its position as a safe-haven asset amid macroeconomic instability.

The simultaneous rise of both assets suggests that investors are increasingly diversifying away from fiat-denominated instruments in response to mounting debt, currency devaluation, and interest rate volatility.

A Portfolio Hedge for an Uncertain Future

Dalio’s updated stance on Bitcoin—while still measured—reflects a growing recognition among traditional investors that digital assets may play a role in protecting wealth in turbulent macroeconomic environments.

His recommendation to allocate 15% of a portfolio to Bitcoin and/or gold is a notable signal to investors looking to navigate what he describes as a “debt doom loop” in the U.S. economy.

As debt levels continue to rise and government borrowing accelerates, store-of-value assets may increasingly become essential components of a resilient, long-term investment strategy.