Bitcoin Eyes ‘Healthy Pause’ Around $106K Before Gaining Momentum Again

Bitcoin (BTC) may be entering a period of sideways consolidation following recent court decisions on former President Donald Trump’s tariff policies, but that doesn’t signal bearishness, according to analysts.

Nick Forster, founder of onchain options protocol Derive, told Cointelegraph that while Bitcoin’s surge to over $111,000 was significant, “the current price action suggests a phase of consolidation rather than an imminent breakout.”

A Necessary Pause to Digest Gains

“This consolidation phase could serve as a healthy pause,” Forster explained. “It gives the market time to digest recent gains and prepare for the next leg up.”

Bitcoin has gained over 11.5% in the past 30 days, reaching an all-time high of $111,970 on May 22. As of this writing, it is trading near $105,881, according to CoinMarketCap.

What Comes Next?

While the future is uncertain, Bitcoin researcher Sminston With predicts a possible 100% to 200% gain, with a cycle peak between $220,000 and $330,000. Crypto trader Apsk32 offered a more conservative 2025 target of $220,000.

Forster noted that the U.S. Court of International Trade’s May 28 ruling against Trump’s sweeping tariffs alleviated fears of trade-induced inflation — at least temporarily. However, a subsequent May 29 ruling by the Federal Circuit Court allowed Trump to continue the tariff policy under emergency powers while the decision is appealed.

Fed’s June Decision Could Be Key

Forster emphasized the importance of the U.S. Federal Reserve’s upcoming interest rate decision on June 18, calling it “pivotal” for markets.

A Surprisingly Strong Q3?

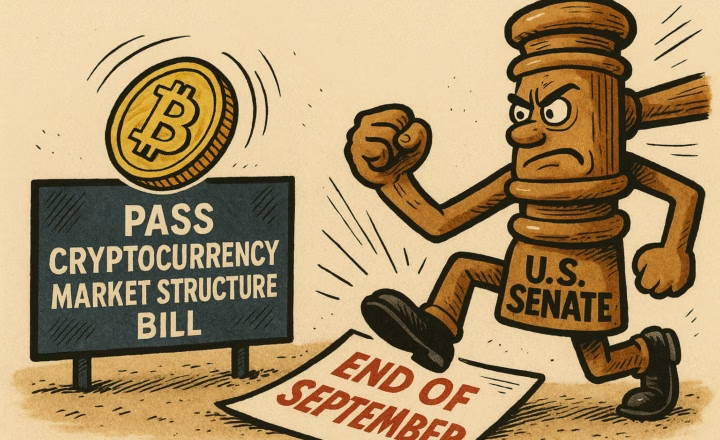

Historically, Bitcoin’s Q3 performance has been weaker, with an average return of just 6.03%, according to CoinGlass. But Forster believes 2025 may be an exception, citing favorable regulatory developments and sustained institutional interest.

Q4 remains Bitcoin’s strongest quarter historically, averaging an 85.42% gain.

ETF Inflows Yet to Be Fully Priced In

Forster also pointed out the disconnect between the large capital inflows into Bitcoin ETFs and the actual spot market price.

“Despite significant inflows — over $6.2 billion into BlackRock’s IBIT in May alone — Bitcoin’s price hasn’t surged proportionately,” he said.

This discrepancy may be due to the nature of institutional ETF investments, which often don’t immediately impact spot markets. During the week ending May 23 alone, spot Bitcoin ETFs saw a combined inflow of $2.75 billion.

In summary, Bitcoin’s current pullback appears to be a constructive pause in its long-term upward trend, with analysts seeing continued upside as regulatory and institutional momentum builds.